Forgiving Student Debt is a Massive Wealth Transfer from the Poor to the Rich

Former Vice President Biden announced plans to forgive at least $10,000 in student debt for individuals earning less than $125,000 per year, and $250,000 for families1. The majority of Americas are concerned that this will drive up inflation2. With less than 15% of Americans currently holding student loans3, this will be nothing more than a massive wealth transfers from laborers to those in the upper middle class.

My Journey Through Student Loans

I had parents that valued higher education over nearly every other life choice. Education is what helped them escape a struggling country after growing up in a war, and helped them achieve the American dream. They paid for the undergraduate degrees of both myself and my sister. Both of us went to affordable state schools. Even when adding up tuition, books, and lab fees, many of my friends and roommates could afford school by means of Pell Grants and part-time work. Few of us had large student loans. People I knew who went to more expensive schools, both private and public, would tell me of racking up $20,000 or more in debt.

I paid for my own graduate school, while working full time as a software engineer. Two of my jobs paid for some of my classes, as they related to my career. I watched other students, both undergraduate and graduate, blow the remainder of their student loans on insane gaming computers and electronics. I typically took the remains of my student loan checks and immediately applied them to the principals of those loans.

At one point I paid off my car loan, with its 5% interest rate, using a student loan check. However, once I graduated, I was informed in six months my student loan interest would be over 6%. My car loan from a local credit union had a lower interest than my federally subsidized student loans!

In 2010, I sold the domain to my person weblog for $10,000 USD. I used that windfall, plus some of my savings, to pay off all my remaining loans. Less than a month later, my contract was canceled, and I was unemployed. I had just moved to Cincinnati with very little savings remaining, but at least I wasn’t in debt.

My Views on High Education and Student Loans

The continuing rising cost of education had made me question its value. I do believe I got a lot out of my university degrees, but I also realize you only get out of any education program what you put into it. When my nephew was getting ready to graduate high school, I sent him a long e-mail with a lot of things I wish people had told me about school and my industry (the one he was considering and has entered into). My biggest piece of advice to him was to not go into debt if he could avoid it. A more expensive school does not give you a better education.

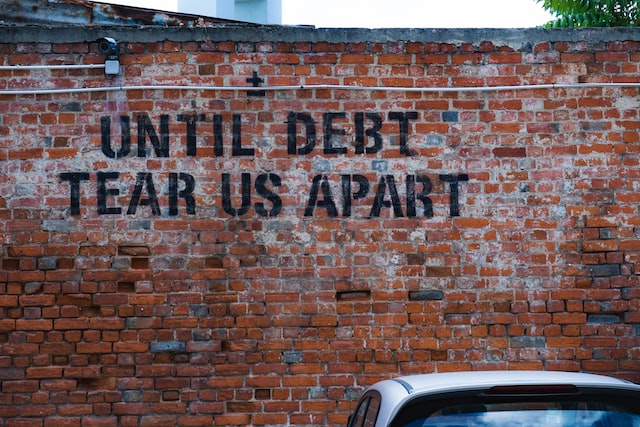

Student loans are predatory. They involve a contract that people can enter into in the US while under the age of 18. People cannot declare bankruptcy on most student loans. Because of these issues, I used to follow Graeber’s view on student debt.

“…Cancel all student loan debt? But that would be unfair to all those people who struggled for years to pay back their student loans!’ Let me assure the reader that, as someone who struggled for years to pay back his student loans and finally did so, this argument makes about as much sense as saying it would be ‘unfair’ to a mugging victim not to mug their neighbors too.)” -David Graeber4

Graeber treats student loans as if they are some massive enslavement system imposed by mafia style loan-sharks. However, most people in this situation can afford to pay their loans.

One third of Americans with student debt owe less than $10,000. Only 20% of borrowers owe between $10,000 and $20,0005. Less than 5% of Americans with student debt, have debt over $100,000. Only 1.2% of those with student loans owe over $200,0006.

In Graeber’s book, Debt: The First 5,000 Years, he continually talks about debt forgiveness. In much of the ancient world, new emperors and kings came to power, and immediately relieved previous debts. It seems like an inevitability, with world leaders pushing the World Economic Forums’s plans for a Great Reset. However, would any of these massive issuance of forgiveness truly reset such societies? After all, those who support the new rulers with their own power and influence would surely be given certain privileges, even over the peasants who were cleared of their obligations?

The Bible mandated a Sabbatical year, every seven years, when all debts were to be forgiven7. In reality, rabbis created The Prozbul, which changed the status of individual private loans to keep people in debt, protecting the investments of lenders.

There is Already a Process for Debt Forgiveness

We no longer officially have debtors prisons. There are cases where creditors, and even municipal governments8, can abuse the existing system to criminally prosecute debtors9. Still, in an ideal and constitutional society, we should not be putting people in prison for failure to pay debts. Instead, we have a process for people who have fallen so far into debt they can not justifiably find a way out: bankruptcy.

Ultimately, if a borrower fails to repay a loan, it is the creditor who must eat that cost. The bank or credit card company should have known better, through their use of risk assessment and credit scores. Bankruptcy comes at a substantial cost to an individual. Nearly all of their high value possessions are often lost, arbitrated by a court, with the results being divided between all creditors. What is not paid is written off as a loss, and it can be years before that individual can get meaningful lines of credit again.

Student loans are not subject to bankruptcy, but they should be. A university cannot repossess a diploma or credential. They could refuse to verify a degree, but third party agencies could archive such records and offer them for a fee, in the same way some agencies collect information from criminal background records that have been expunged. Furthermore, universities that attempt such a practice may face ethics concerns. Potential students may also be more reluctant to give money to a school that would later deny proof of their hard work, should they fall on hard times.

The free market is what’s truly needed in universities. The presence of federally subsidized loans is what has caused such a massive increase in tuition fees. Schools know that money is coming, and that young impressionable students will take those loans without considering the long term implications. This broken system is what leads to continual tuition hikes, which leads to even larger student loans.

Most Graduates Can Pay Their Debts

The vast majority of Americans do not owe student debt that is greater than the value of a reasonable car. Graduates that are smart, pay their other bills on time, and haven’t racked up credit card debt, are likely wise enough to take out lower interest cash loans to repay higher interest student loans (something I had been considering before the windfall I encountered). Graduates who have paid off their college debt with lower interest cash loans, will likely not qualify for any forgiveness. They will be left to pay more after making seemingly wise financial decisions.

I do not fault any America who takes the proposed $10,000 to $20,000. You should absolutely take the money if it is offered, but you should also be aware it is a means by which Democrats are attempting to purchase your vote. It comes, not only at the expense of everyone like me who paid off their student loans responsibly, but also at the expense of every garbage man, farmer and factory worker who never went to university10. Only 13.5% of Americans hold student debt3. The other 86.5% of working class Americans, both unskilled and those who went to reasonably priced vocation or trade schools, are now footing the bill for upper class Americans and their overpriced, overvalued degrees.

The Great Devaluation

The current student loan system is hopelessly broken. Debt forgiveness is the wrong solution. The system has to break somewhere, and it should break with the universities who charge too much and offer too little value. Their bubble needs to pop, paving the way for more affordable schools with useful programs, instead of useless gender study degrees, racist inclusivity programs and classes on pronoun usage. Bankruptcy for student loans, as well as an end to all federal subsidies, is the only reasonable way that can happen.

Debt forgiveness doesn’t mean the debt goes away, it just transfers that debt to the American taxpayer. It ultimately devalues the savings and retirements of the previous generation of college graduates, and further drives the wedge that is fracturing our society apart.

-

The Education Department has a plan for canceling student debt — if Biden gives the word. 28 July 2022. Stratford. Politico. ↩

-

CNBC POLL: 59% of Americans are concerned that canceling student loan debt will make inflation worse.. 22 August 2022. @RNCResearch. ↩

-

Student Loan Debt Statistics: 2022. 24 August 2022. Helhoski. Lane. Nerdwallet. ↩ ↩2

-

Debt: The First 5,000 Years. Graeber. 2011. (Location 7834 / Chapter 12: 1971–The Beginning of Something Yet to Be Determined) ↩

-

More than half of federal student loan borrowers owe less than $20,000 — here’s where everyone else stands. 12 July 2022. Graiver. CNBC. ↩

-

US Student Loan Debt Statistics Chamber of Commerce. Retrieved 25 August 2022. Archive ↩

-

Deuteronomy 15 ↩

-

The New Debtors’ Prisons. 5 April 2009. The New York Times. ↩

-

The Return Of Debtor’s Prisons: Thousands Of Americans Jailed For Not Paying Their Bills. 13 December 2011. Diamond. ThinkProgress. ↩

-

This is what forgiving student loans will do #shorts. 24 August 2022. PragerU. ↩